Important notice: We are currently performing maintenance updates. Should you experience any technical issues, please return later and try again. We apologise for the inconvenience.

Important notice: We are currently performing maintenance updates. Should you experience any technical issues, please return later and try again. We apologise for the inconvenience.

Leave your details and we’ll call you back with a quote

While we all hope that an accident never happens to us, being prepared, just in case anything happens, can give us invaluable peace of mind. Taking out our Personal Accident cover gives you just that. If you’re injured, admitted to hospital, become disabled or pass away due to an accident, this policy will cover you. With no medical examinations required and a discount when you add your partner or spouse, this insurance will be there for you when you need it most.

· 24HR Medical Emergency Evacuation in the event of an accident.

· Cover for non-medical expenses should you be injured and hospitalised due to an accident.

· Tax-free payout due to death or disablement of the insured as a result on an accident.

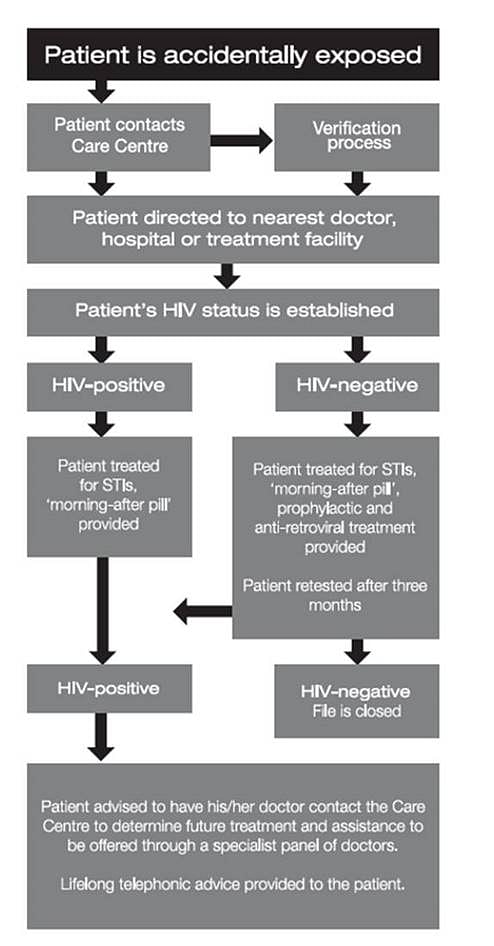

· Assistance should you be exposed to HIV due to an accident.

· Access to professional trauma counselling as a result of an accident.

· Assistance with submitting a claim against the Road Accident Fund.

Children are also covered for the maximum amounts below:

• R20 000 for children unborn to 6 years old.

• R50 000 for children 7 to 14 years old.

• 25% of the main member’s cover for children between 15 and 21, and up to 25 if they are registered full-time students.

In the event that you are hospitalised, as a result of an accident, we will cover non-medical expenses from the first day of hospital admission, up to a maximum of 104 weeks.

Should you die as a result of an accident, we will compensate your nominated beneficiary/ies or estate to the level of cover chosen. Compensation will be paid in one lump sum and this payment will be tax-free.

Should you suffer disablement as a result of an accident, we will compensate you according to the scale of benefits and level of cover chosen.

THE PERSONAL ACCIDENT POLICY IS NOT A MEDICAL SCHEME AND THE COVER IS NOT THE SAME AS THAT OF A MEDICAL SCHEME. THIS POLICY IS NOT A SUBSTITUTE FOR MEDICAL SCHEME MEMBERSHIP.

| Individual Cover | Disability | Death | Hospital |

|---|---|---|---|

| PLAN A Plus | R50 000 | R50 000 | R500 p/day |

| PLAN B Plus | R150 000 | R150 000 | R750 p/day |

| PLAN C Plus | R250 000 | R250 000 | R1000 p/day |

| PLAN D Plus | R350 000 | R350 000 | R1250 p/day |

| PLAN E Plus | R500 000 | R500 000 | R1500 p/day |

Refer to Terms and Conditions for a full list of exclusions.

To claim on your policy you need to contact our call centre on 0860 10 95 71 from Monday to Friday, between 08:00 and 17:00 and one of our helpful consultants will guide you through the process.

Your policy is payable on a monthly basis through debit order. Your premium is deducted on the date stated on your schedule to provide cover for the following month.

If, in the month after the activation of your policy (and onwards), we do not receive your premium on the due deduction date, you will be allowed a 15-day period of grace in which to pay your premium. If we still do not receive your premium after these 15 days, you will not have cover for that month.